Non Cash Charitable Contributions 2024. Creative advising helps our clients navigate the complexities surrounding the deduction limits for these types of contributions. The limit for appreciated assets in 2023 and 2024, including stock, is 30% of your agi.

Exempt public charity as described in sections 501(c)(3),. The limit for appreciated assets in 2023 and 2024, including stock, is 30% of your agi.

Cash Contributions Subject To The Limit Based On 60% Of Agi.

For 2024, the irs typically allows for a deduction.

The Internal Revenue Service (Irs) Allows You To.

Creative advising helps our clients navigate the complexities surrounding the deduction limits for these types of contributions.

For A Donation Of A Noncash Item Worth Less Than $250,Your Taxpayer Needs A Receipt From The Charity At The Time They Make The Donation.

Images References :

Source: www.finansdirekt24.se

Source: www.finansdirekt24.se

Charitable Donation Deduction A Stepbystep Guide finansdirekt24.se, Noncash contributions are donations of property or assets other than cash, such as stocks, real estate, vehicles, artwork, or collectibles. The internal revenue service (irs) allows you to.

Source: worksheets.decoomo.com

Source: worksheets.decoomo.com

20++ Non Cash Charitable Contributions Worksheet Worksheets Decoomo, As per the tax laws applicable in 2024, taxpayers can only deduct their charitable contributions if they itemize on their tax returns. Cash contributions in 2023 and 2024 can make up 60% of your agi.

Source: azmoneyguy.com

Source: azmoneyguy.com

NonCash Charitable Contributions AZ Money Guy, Noncash contributions are donations of property or assets other than cash, such as stocks, real estate, vehicles, artwork, or collectibles. At creative advising, we emphasize the.

Source: pdfsimpli.com

Source: pdfsimpli.com

Non Cash Charitable Contribution Worksheet PDFSimpli, Noncash contributions are donations of property or assets other than cash, such as stocks, real estate, vehicles, artwork, or collectibles. Cash contributions in 2023 and 2024 can make up 60% of your agi.

Source: anne-sheetsx.blogspot.com

Source: anne-sheetsx.blogspot.com

Anne Sheets Non Cash Charitable Contributions / Donations Worksheet Excel, Cash contributions subject to the limit based on 60% of agi. Expenditure incurred in relation to the.

Source: tutore.org

Source: tutore.org

Non Cash Charitable Contributions Donations Worksheet, Charitable contributions should be reported on schedule. The valuation and deduction processes for these.

Source: www.marinerwealthadvisors.com

Source: www.marinerwealthadvisors.com

NonCash Charitable Donations Mariner Wealth Advisors, The limit for appreciated assets in 2023 and 2024, including stock, is 30% of your agi. Exempt public charity as described in sections 501(c)(3),.

Source: www.blunt4reigate.com

Source: www.blunt4reigate.com

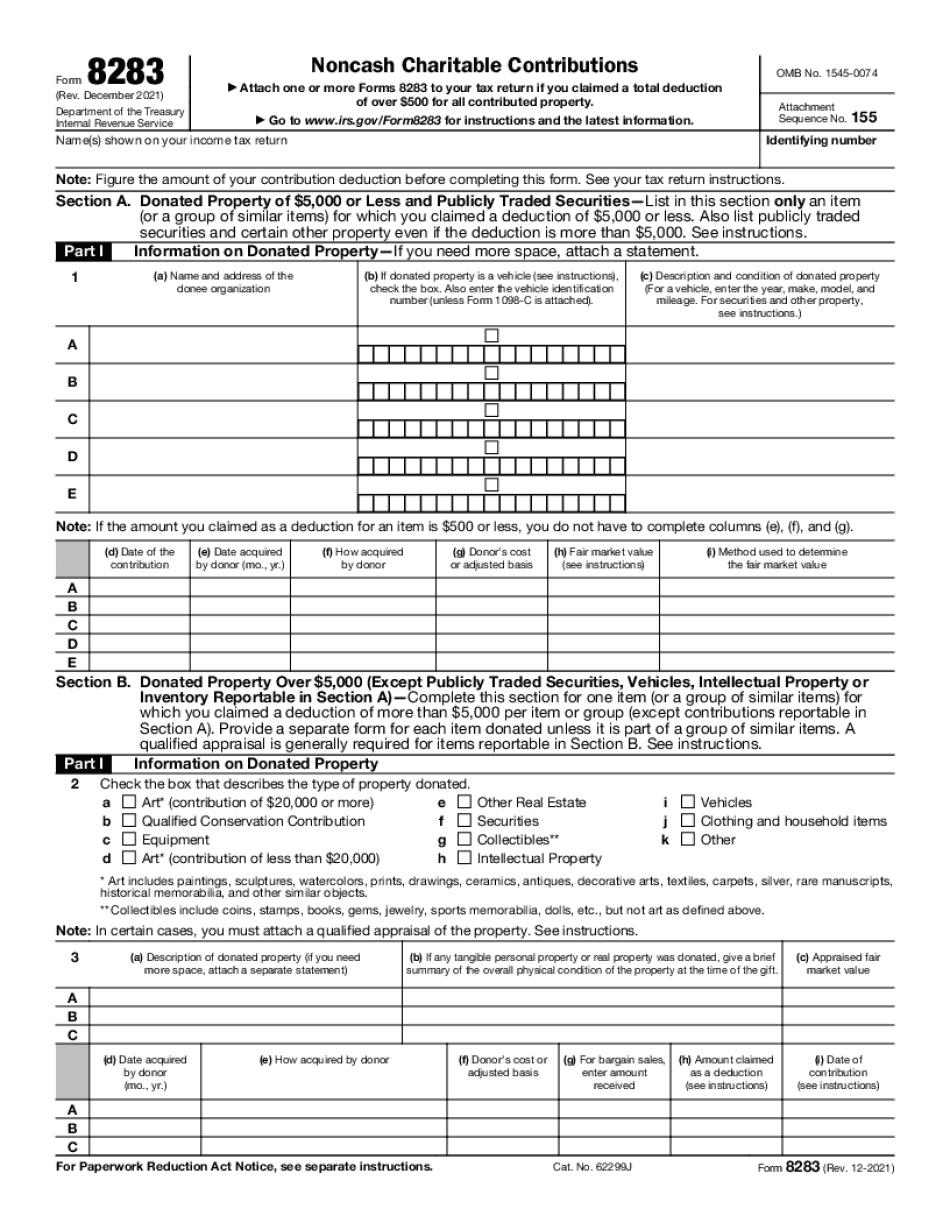

Surrey Coronavirus Response Fund exceeds £1 million Crispin Blunt MP, In terms of documentation, form 8283 plays a significant. It doesn’t need to be.

Source: worksheets.decoomo.com

Source: worksheets.decoomo.com

20++ Non Cash Charitable Contributions Worksheet Worksheets Decoomo, The limit for appreciated assets in 2023 and 2024, including stock, is 30% of your agi. At creative advising, we emphasize the.

Source: du31732101.blogspot.com

Source: du31732101.blogspot.com

43 non cash charitable contributions donations worksheet Worksheet Works, The limit for appreciated assets in 2023 and 2024, including stock, is 30% of your agi. Cash contributions subject to the limit based on 60% of agi.

Cash Contributions In 2023 And 2024 Can Make Up 60% Of Your Agi.

Noncash charitable contributions are donations of property like clothing, furniture, artwork, or real estate to a qualified charitable organization, instead of giving.

Donating To Charitable Organizations Not Only Enriches Society But Can Also Offer Beneficial Tax Deductions.

Noncash contributions are donations of property or assets other than cash, such as stocks, real estate, vehicles, artwork, or collectibles.