2024 Bonus Depreciation Amount Worksheet. You may use the depreciation worksheet, later, to assist you in maintaining depreciation records. Once you understand what each part of this tax form does, you can plan ways to use it to.

In 2024, the bonus depreciation rate will drop to. Bonus depreciation allows qualifying businesses that spend more than the 2024 section 179 limit to depreciate up to 60% on the remaining purchase amount.

2024 Bonus Depreciation Amount Worksheet Images References :

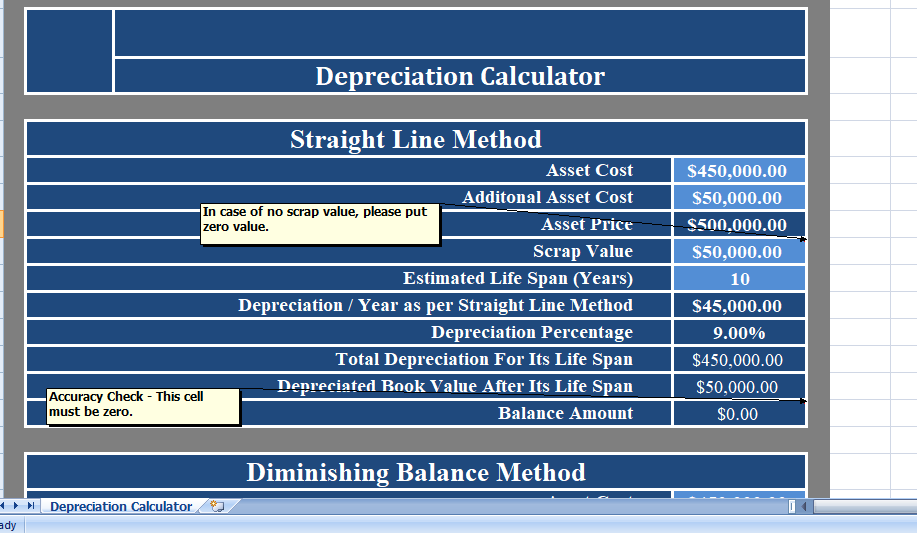

Source: allixyclarisse.pages.dev

Source: allixyclarisse.pages.dev

Section 179 Bonus Depreciation 2024 Calculator Dani Millie, The election must be made by filing a statement with form 4562, “depreciation and amortization,” by the due date, including extensions, of the federal tax return for the.

Source: nannyqshaylynn.pages.dev

Source: nannyqshaylynn.pages.dev

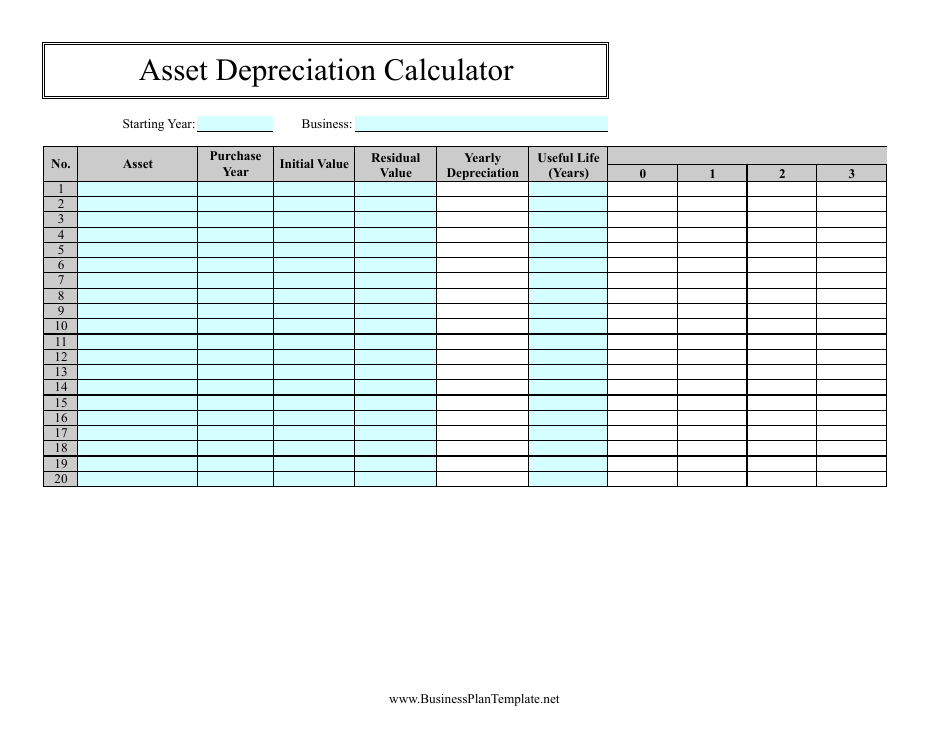

Bonus Depreciation Calculator 2024 Viki Melanie, Bonus depreciation is a tax incentive that allows a business to immediately deduct a large percentage of the purchase price of eligible assets, such as machinery, rather than write them off.

Source: nannyqshaylynn.pages.dev

Source: nannyqshaylynn.pages.dev

Bonus Depreciation Calculator 2024 Viki Melanie, Bonus depreciation allows qualifying businesses that spend more than the 2024 section 179 limit to depreciate up to 60% on the remaining purchase amount.

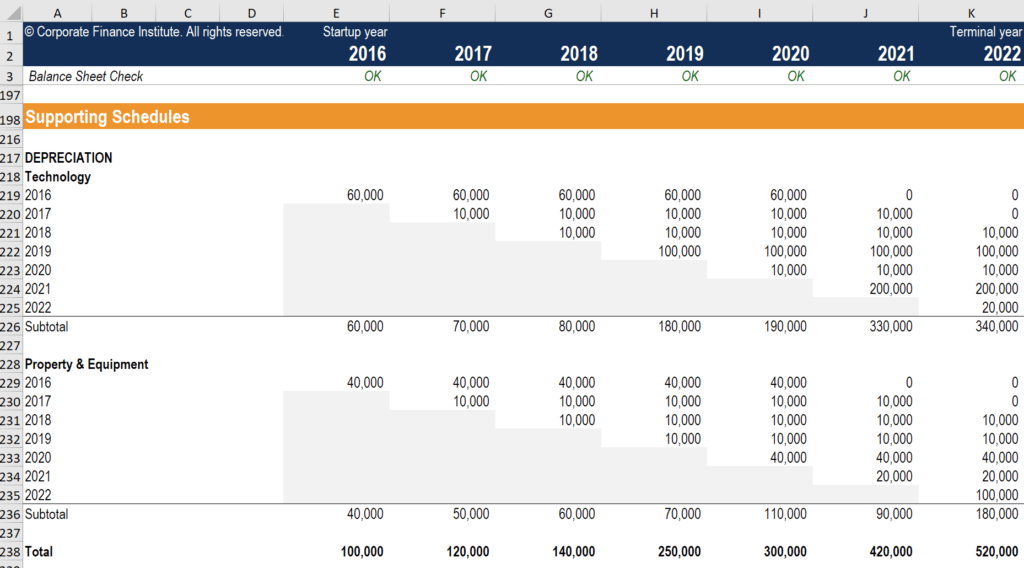

Source: sailsojourn.com

Source: sailsojourn.com

8 ways to calculate depreciation in Excel (2024), This guide offers a detailed look into the mechanics and strategic application of bonus depreciation in 2024, particularly focusing on new developments and how businesses.

Source: brynayrachelle.pages.dev

Source: brynayrachelle.pages.dev

Bonus Depreciation Bill 2024 Joice Wrennie, For 2023, businesses can take advantage of 80% bonus depreciation.

Source: mameymalynda.pages.dev

Source: mameymalynda.pages.dev

Section 179 Bonus Depreciation 2024 Calculator Babb Mariam, Bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s cost upfront instead of spreading the deduction out over its useful life.

Source: deebnicoli.pages.dev

Source: deebnicoli.pages.dev

2024 Bonus Depreciation Rate Rivi Vickie, Bonus depreciation is an accelerated form of depreciation — it allows you to deduct a fixed percentage (80% for 2023) of an asset’s cost upfront instead of spreading the deduction out over its useful life.

2024 Bonus Depreciation For Vehicles Caryn Cthrine, Rentprep’s complete guide on bonus depreciation leads you through what bonus depreciation is and how you may want to apply it to your business.

Source: juliannawrheba.pages.dev

Source: juliannawrheba.pages.dev

Bonus Depreciation 2024 Irs Xylia Katerina, If you do not claim depreciation you are entitled to deduct, you must still reduce the basis of the property by the full amount of depreciation allowable.

Source: vonniqlindie.pages.dev

Source: vonniqlindie.pages.dev

2024 Bonus Depreciation Rules Blair Chiarra, You may need to keep.